The Enduring value of precious metals

In a world driven by digital currencies and fast-moving markets, physical assets like gold, silver, and rare coins remain in a cornerstone of smart, resilient investing. Precious metals have preserved wealth for centuries, and today, and they continue to prove their worth as both a hedge against inflation and a symbol of stability in uncertain times.

Why Precious Metals Matter

Gold and silver are more than commodities — they are global stores of value. Unlike paper money, which can lose purchasing power through inflation, precious metals retain intrinsic worth. Their limited supply, industrial demand, and historic role in monetary systems make them uniquely positioned for long-term appreciation.

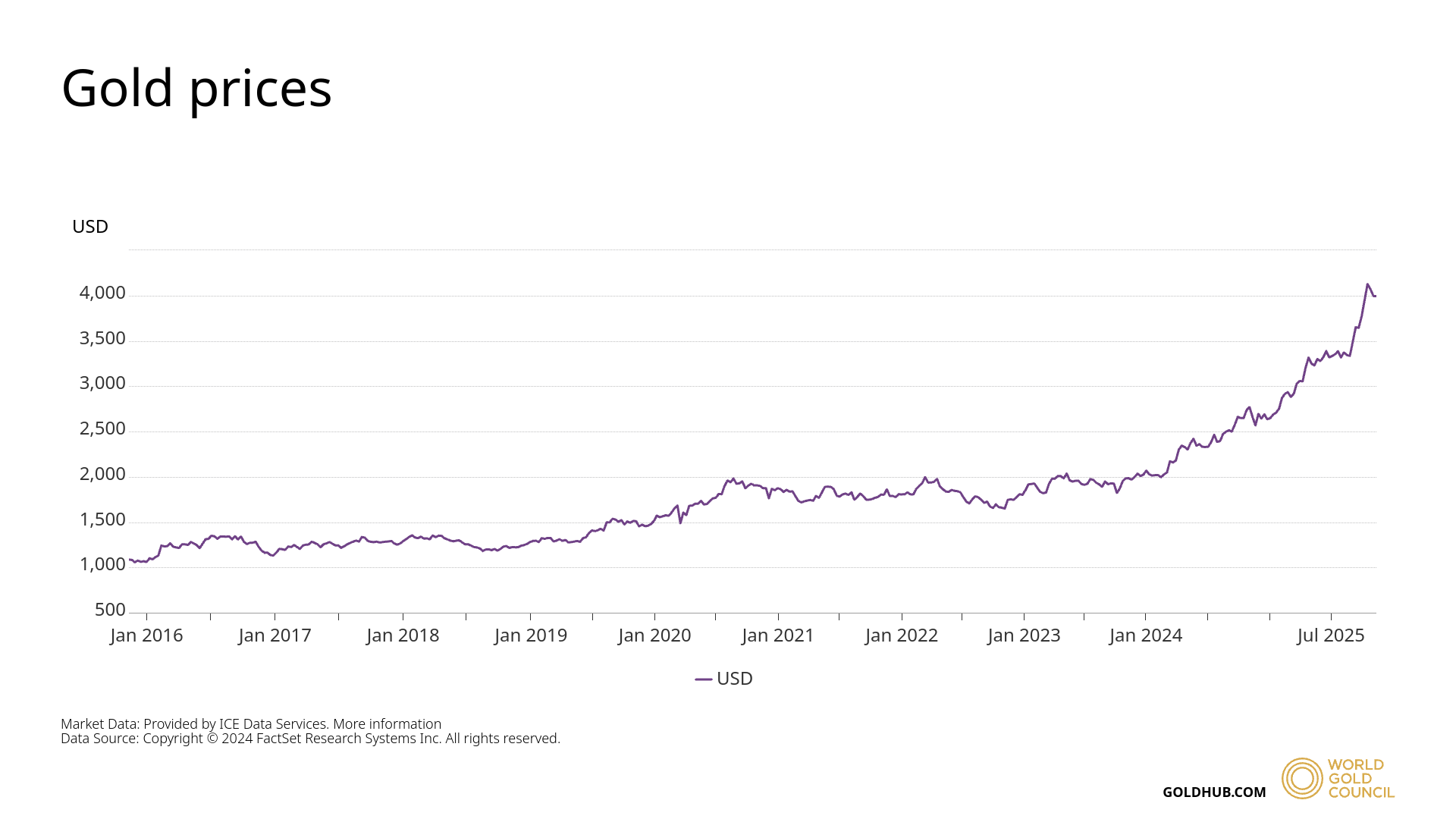

Growth in Modern Markets

In recent years, interest in metals and collectible coins has surged. Investors and collectors alike are turning toward tangible assets to diversify portfolios ad reduce exposure to volatile markets. As technology, mining constraints, and geopolitical uncertainty continue to shape global trade, the value of gold, silver, and other rare metals is expected to climb steadily.

Beyond the Investment: Heritage and Rarity

Rare coins offer a distinctive blend of financial and historical value. Each piece carries a story — a reflection of an era, culture, and craftsmanship that cannot be replicated. Collecting these coins combines the strategic thinking of investment with the appreciation of artistry and legacy.

A Smart Hedge for the Future

Unlike traditional market assets, precious metals hold a unique appeal due to their physical nature and enduring value. They serve as a safeguard against inflation, currency fluctuations, and global uncertainty. As economies evolve and digital currencies rise, metals like gold, silver, and platinum continue to maintain their relevance — bridging the gap between modern investing and timeless wealth preservation.

Final Thoughts

As global economies evolve, one truth remains constant: precious metals hold their ground. Whether for wealth preservation, diversification, or heritage, investing in gold, silver, and rare coins continues to be one of the most stable and proven financial strategies available.

At Cyber Invest Coin, we believe that every collection tells a story — and every metal hold promise for the future.